All Categories

Featured

Table of Contents

Maintaining all of these phrases and insurance policy types straight can be a headache. The following table puts them side-by-side so you can quickly separate amongst them if you get perplexed. One more insurance policy protection type that can settle your home loan if you die is a conventional life insurance policy policy

A is in place for an established number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away during that term. A gives insurance coverage for your whole life period and pays out when you pass away.

One typical guideline is to aim for a life insurance policy plan that will pay up to ten times the insurance policy holder's income amount. You may pick to make use of something like the Penny method, which adds a family's financial obligation, earnings, mortgage and education expenditures to determine exactly how much life insurance policy is required.

There's a reason new property owners' mail boxes are commonly pounded with "Last Possibility!" and "Urgent! Action Needed!" letters from home loan defense insurance companies: Numerous only enable you to purchase MPI within 24 months of shutting on your home loan. It's also worth noting that there are age-related restrictions and limits imposed by almost all insurance companies, that typically will not give older purchasers as several options, will charge them more or may reject them outright.

Here's how mortgage defense insurance determines up versus conventional life insurance policy. If you have the ability to receive term life insurance policy, you ought to prevent mortgage protection insurance policy (MPI). Contrasted to MPI, life insurance policy uses your household a less expensive and a lot more adaptable advantage that you can rely on. It'll pay out the same quantity anytime in the term a death occurs, and the money can be made use of to cover any type of costs your household considers required back then.

In those situations, MPI can offer great satisfaction. Just be sure to comparison-shop and read every one of the fine print prior to enrolling in any kind of policy. Every home loan protection alternative will certainly have countless policies, policies, benefit choices and drawbacks that require to be evaluated thoroughly versus your specific circumstance (compare mortgage payment protection).

Mortgage Protection Life Cover

A life insurance plan can aid pay off your home's home loan if you were to pass away. It's one of many means that life insurance policy may aid secure your enjoyed ones and their economic future. Among the very best means to factor your mortgage into your life insurance coverage demand is to speak with your insurance policy agent.

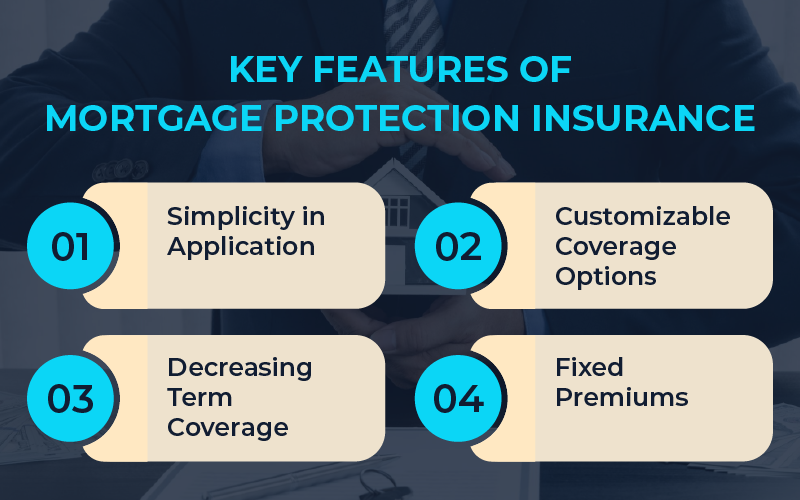

Rather of a one-size-fits-all life insurance policy plan, American Domesticity Insurance coverage Firm provides policies that can be made especially to meet your family members's needs. Below are some of your options: A term life insurance policy plan. term life insurance mortgage protection is energetic for a certain amount of time and commonly offers a bigger amount of protection at a lower price than a permanent plan

A entire life insurance policy is simply what it sounds like. Instead than just covering a set number of years, it can cover you for your whole life. It additionally has living benefits, such as cash value buildup. * American Family Members Life Insurer provides different life insurance policy plans. Talk with your agent concerning customizing a policy or a mix of policies today and obtaining the assurance you are entitled to.

Your agent is a terrific resource to answer your questions. They might additionally have the ability to help you locate voids in your life insurance policy protection or new ways to minimize your various other insurance coverage. ***Yes. A life insurance policy recipient can pick to utilize the survivor benefit for anything - mortgage life and disability. It's a great method to help guard the economic future of your family members if you were to die.

Life insurance coverage is one method of assisting your family members in paying off a home loan if you were to pass away prior to the home loan is entirely paid back. Life insurance policy earnings might be made use of to help pay off a home loan, but it is not the exact same as mortgage insurance that you could be required to have as a problem of a car loan.

Mortgage Vs Life Insurance

Life insurance coverage might help guarantee your house remains in your family by giving a death advantage that might help pay down a home mortgage or make vital acquisitions if you were to pass away. This is a brief summary of coverage and is subject to policy and/or motorcyclist terms and conditions, which may differ by state.

Words life time, long-lasting and permanent are subject to plan terms and problems. * Any fundings taken from your life insurance coverage policy will build up passion. can you get ppi on mortgages. Any superior finance equilibrium (funding plus interest) will be subtracted from the fatality advantage at the time of case or from the money value at the time of surrender

Price cuts do not use to the life plan. Policy Types: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

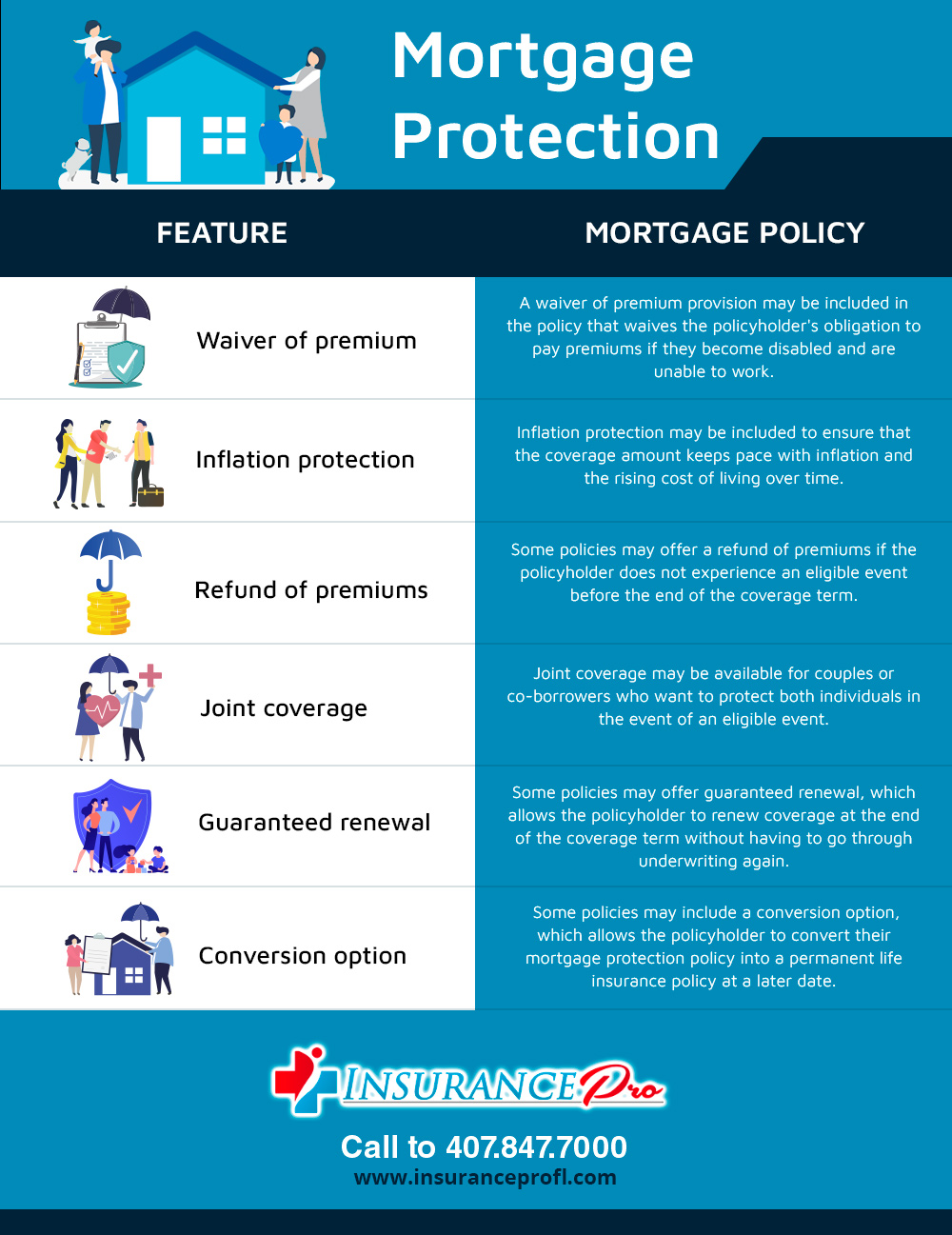

Mortgage security insurance coverage (MPI) is a different kind of guard that might be valuable if you're not able to settle your home mortgage. Home loan protection insurance is an insurance coverage policy that pays off the remainder of your home mortgage if you pass away or if you come to be handicapped and can't work.

Like PMI, MIP safeguards the loan provider, not you. However, unlike PMI, you'll pay MIP for the duration of the car loan term, in the majority of situations. Both PMI and MIP are needed insurance coverage coverages. An MPI policy is completely optional. The quantity you'll pay for home mortgage protection insurance policy depends upon a range of variables, consisting of the insurance company and the existing equilibrium of your mortgage.

Still, there are benefits and drawbacks: Many MPI policies are provided on a "assured approval" basis. That can be useful if you have a health and wellness problem and pay high prices forever insurance coverage or struggle to get coverage. can i claim back mortgage life insurance. An MPI plan can give you and your household with a feeling of security

How Much Is Mortgage Protection Insurance Per Month

You can choose whether you need home mortgage security insurance policy and for how long you require it. You might want your home mortgage security insurance policy term to be close in length to exactly how long you have left to pay off your home mortgage You can cancel a home mortgage defense insurance coverage policy.

Table of Contents

Latest Posts

Final Expense Companies

Decoding How Investment Plans Work A Comprehensive Guide to Investment Choices What Is Variable Annuity Vs Fixed Indexed Annuity? Benefits of Choosing the Right Financial Plan Why Fixed Vs Variable An

Burial Insurance Cost

More

Latest Posts

Final Expense Companies

Burial Insurance Cost