All Categories

Featured

Table of Contents

Trustees can be family members, trusted people, or economic institutions, depending on your preferences and the complexity of the trust. The objective is to ensure that the trust is well-funded to satisfy the kid's long-lasting economic demands.

The role of a in a child support count on can not be underrated. The trustee is the private or company liable for handling the trust's properties and making certain that funds are distributed according to the regards to the trust fund arrangement. This includes making certain that funds are utilized entirely for the child's benefit whether that's for education, medical treatment, or daily costs.

They have to likewise give regular reports to the court, the custodial moms and dad, or both, depending upon the terms of the count on. This liability guarantees that the depend on is being managed in a means that benefits the kid, preventing misuse of the funds. The trustee also has a fiduciary task, suggesting they are legally obliged to act in the finest interest of the youngster.

By purchasing an annuity, moms and dads can ensure that a repaired amount is paid out routinely, no matter any type of changes in their earnings. This gives satisfaction, understanding that the kid's requirements will certainly continue to be met, regardless of the economic circumstances. Among the essential benefits of making use of annuities for youngster assistance is that they can bypass the probate process.

How do I choose the right Annuity Interest Rates for my needs?

Annuities can also provide defense from market changes, making sure that the kid's monetary assistance remains stable also in unstable financial problems. Annuities for Kid Assistance: A Structured Solution When establishing, it's essential to think about the tax obligation effects for both the paying parent and the child. Trust funds, depending on their structure, can have different tax obligation therapies.

In various other situations, the recipient the youngster may be accountable for paying taxes on any kind of distributions they receive. can also have tax effects. While annuities supply a secure revenue stream, it is essential to understand exactly how that earnings will certainly be strained. Depending on the structure of the annuity, repayments to the custodial moms and dad or kid may be considered taxable revenue.

Among the most significant benefits of making use of is the capacity to safeguard a youngster's monetary future. Depends on, in specific, use a level of security from creditors and can make certain that funds are made use of responsibly. A trust fund can be structured to guarantee that funds are just made use of for particular objectives, such as education or medical care, avoiding abuse.

What is the most popular Immediate Annuities plan in 2024?

No, a Texas kid support trust is especially designed to cover the kid's important demands, such as education and learning, medical care, and daily living costs. The trustee is legitimately obliged to guarantee that the funds are used entirely for the advantage of the kid as described in the count on agreement. An annuity offers structured, foreseeable repayments in time, making certain regular financial backing for the child.

Yes, both youngster support depends on and annuities come with possible tax ramifications. Count on revenue may be taxable, and annuity repayments could likewise be subject to taxes, depending on their structure. Since several elders have actually been able to save up a nest egg for their retirement years, they are usually targeted with fraudulence in a means that more youthful people with no financial savings are not.

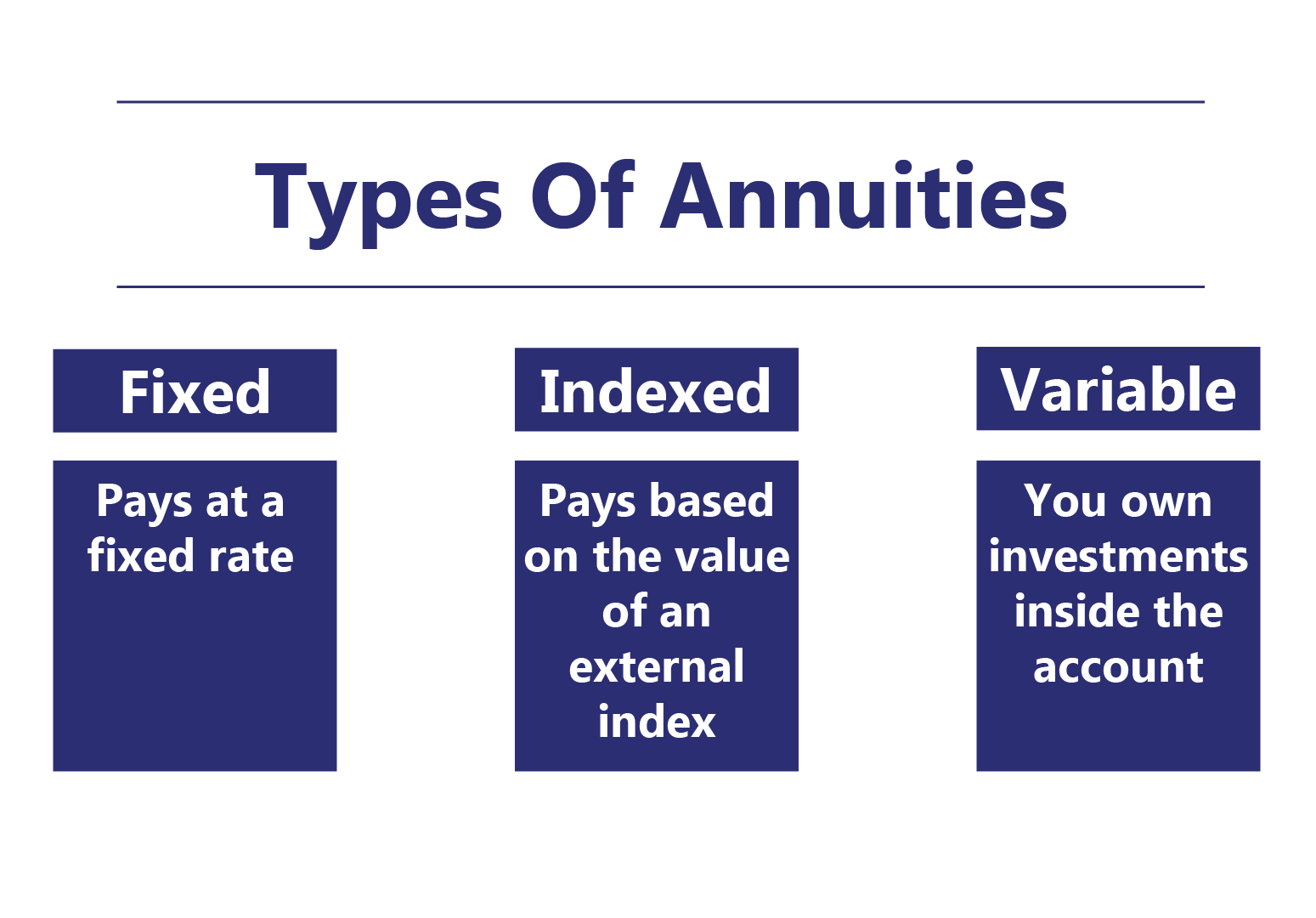

In this environment, customers need to arm themselves with details to protect their interests. The Attorney general of the United States offers the adhering to ideas to take into consideration prior to buying an annuity: Annuities are complicated financial investments. Some bear facility high qualities of both insurance policy and safeties products. Annuities can be structured as variable annuities, fixed annuities, immediate annuities, delayed annuities, and so on.

Customers should check out and comprehend the program, and the volatility of each financial investment listed in the program. Financiers need to ask their broker to describe all terms in the program, and ask inquiries regarding anything they do not recognize. Fixed annuity items might additionally bring dangers, such as long-lasting deferment durations, disallowing investors from accessing all of their money.

The Attorney general of the United States has submitted suits versus insurance provider that marketed improper deferred annuities with over 15 year deferral periods to financiers not anticipated to live that long, or that require access to their money for wellness care or assisted living expenditures (Immediate annuities). Financiers ought to ensure they recognize the long-term repercussions of any type of annuity purchase

How long does an Retirement Annuities payout last?

The most substantial charge linked with annuities is usually the surrender cost. This is the percentage that a consumer is billed if he or she takes out funds early.

Consumers might desire to get in touch with a tax specialist prior to purchasing an annuity. The "security" of the financial investment depends on the annuity. Beware of agents that boldy market annuities as being as safe as or much better than CDs. The SEC warns customers that some vendors of annuities products urge consumers to change to an additional annuity, a technique called "churning." However, representatives might not properly disclose fees connected with switching financial investments, such as new abandonment fees (which usually start over from the day the product is changed), or significantly transformed advantages.

Agents and insurance coverage business might offer benefits to entice financiers, such as additional rate of interest factors on their return. Some unethical representatives urge consumers to make unrealistic financial investments they can't manage, or acquire a long-lasting deferred annuity, also though they will certainly need accessibility to their cash for health and wellness treatment or living expenditures.

This area provides information useful to retirees and their families. There are numerous occasions that might impact your benefits. Gives details often requested by brand-new retired people including altering health and life insurance alternatives, Sodas, annuity repayments, and taxed parts of annuity. Explains exactly how advantages are affected by events such as marital relationship, separation, death of a partner, re-employment in Federal service, or failure to manage one's finances.

What does a basic Fixed Annuities plan include?

Key Takeaways The beneficiary of an annuity is a person or organization the annuity's owner assigns to receive the contract's survivor benefit. Different annuities pay out to beneficiaries in various means. Some annuities might pay the recipient steady repayments after the contract owner's fatality, while other annuities might pay a survivor benefit as a round figure.

Table of Contents

Latest Posts

Final Expense Companies

Decoding How Investment Plans Work A Comprehensive Guide to Investment Choices What Is Variable Annuity Vs Fixed Indexed Annuity? Benefits of Choosing the Right Financial Plan Why Fixed Vs Variable An

Burial Insurance Cost

More

Latest Posts

Final Expense Companies

Burial Insurance Cost