All Categories

Featured

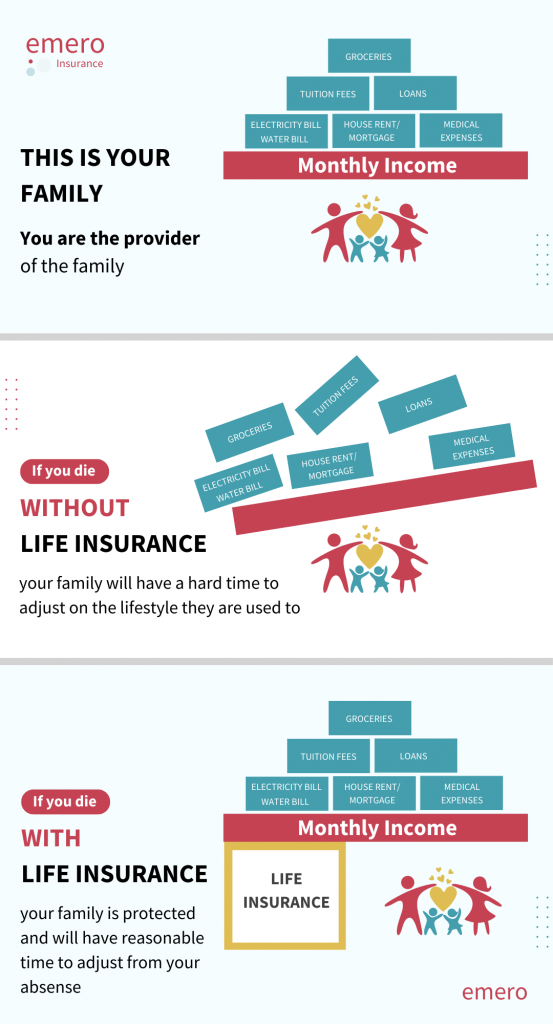

If you're healthy and have never ever utilized cigarette, you'll generally pay even more for mortgage security insurance policy than you would for term life insurance policy (where do you get mortgage insurance). Unlike various other sorts of insurance, it's hard to obtain a quote for mortgage protection insurance online - mortgage insurance if i die. Rates for home mortgage security insurance coverage can differ commonly; there is less openness in this market and there are too numerous variables to properly compare rates

Term life is a superb alternative for home loan defense. Insurance holders can gain from a number of advantages: The quantity of insurance coverage isn't restricted to your home mortgage equilibrium. The fatality payment continues to be the very same for the regard to the policy. The recipients can make use of the plan continues for any function. The policy provides a fatality benefit also after the home loan is paid off.

You may want your life insurance coverage plan to secure greater than just your mortgage. You choose the policy value, so your protection can be basically than your home loan balance. You could also have even more than one plan and "stack" them for tailored protection. By piling policies, or riders on your plan, you could reduce the life insurance benefit gradually as your home mortgage equilibrium decreases so you're not paying for coverage you do not need.

If you're guaranteed and die while your term life plan is still active, your picked loved one(s) can use the funds to pay the home mortgage or for an additional function they pick. how much is mortgage insurance in texas. There are lots of advantages to using term life insurance to shield your mortgage. Still, it may not be a perfect solution for every person

Life Insurance Home Mortgage

Yes and no. Yes, because life insurance policy plans often tend to straighten with the specifics of a home loan. If you get a 250,000 residence with a 25-year mortgage, it makes sense to buy life insurance policy that covers you for this much, for this lengthy. This way if you die tomorrow, or any time throughout the following 25 years, your mortgage can be cleared.

Your household or recipients get their round figure and they can spend it as they like (protection policy insurance). It is necessary to understand, nevertheless, that the Home mortgage Defense payment amount reduces in accordance with your home mortgage term and balance, whereas level term life insurance will pay the very same round figure any time throughout the policy length

Mortgage Level Term Assurance

You could see that as you not getting your payment. But on the other hand, you'll be active so It's not like spending for Netflix. You don't see a noticeable or upfront return for what you purchase. The sum you invest in life insurance policy on a monthly basis does not repay up until you're no longer below.

After you're gone, your loved ones don't need to fret about missing out on settlements or being incapable to afford living in their home (mortgage protection serious illness cover). There are two main ranges of mortgage defense insurance coverage, degree term and reducing term. It's always best to obtain advice to identify the policy that finest talks to your needs, spending plan and conditions

Latest Posts

Final Expense Companies

Decoding How Investment Plans Work A Comprehensive Guide to Investment Choices What Is Variable Annuity Vs Fixed Indexed Annuity? Benefits of Choosing the Right Financial Plan Why Fixed Vs Variable An

Burial Insurance Cost

More

Latest Posts

Final Expense Companies

Burial Insurance Cost