All Categories

Featured

Table of Contents

Term plans are also frequently level-premium, but the overage quantity will certainly stay the very same and not grow. One of the most usual terms are 10, 15, 20, and 30 years, based upon the requirements of the insurance holder. Level-premium insurance policy is a sort of life insurance in which costs remain the very same cost throughout the term, while the quantity of insurance coverage offered rises.

For a term policy, this implies for the size of the term (e.g. 20 or three decades); and for an irreversible policy, till the insured dies. Level-premium plans will usually set you back more up front than annually-renewing life insurance policy policies with terms of just one year at a time. Over the long run, level-premium settlements are commonly much more affordable.

They each look for a 30-year term with $1 million in insurance coverage. Jen buys an ensured level-premium plan at around $42 each month, with a 30-year horizon, for a total amount of $500 per year. However Beth numbers she might just need a strategy for three-to-five years or up until complete settlement of her present debts.

So in year 1, she pays $240 per year, 1 and around $500 by year five. In years 2 through 5, Jen continues to pay $500 each month, and Beth has actually paid approximately simply $357 annually for the exact same $1 countless insurance coverage. If Beth no much longer requires life insurance policy at year 5, she will certainly have saved a great deal of cash relative to what Jen paid.

Everything You Need to Know About Term Life Insurance For Spouse

Yearly as Beth ages, she faces ever-higher yearly premiums. Jen will certainly continue to pay $500 per year. Life insurance firms have the ability to provide level-premium policies by basically "over-charging" for the earlier years of the policy, collecting greater than what is required actuarially to cover the risk of the insured dying during that early period.

Long-term life insurance policy establishes cash value that can be obtained. Plan financings accrue rate of interest and overdue policy finances and rate of interest will minimize the death benefit and money worth of the policy. The amount of cash money worth available will usually depend upon the sort of irreversible plan bought, the amount of protection purchased, the length of time the policy has actually been in force and any outstanding policy fundings.

Disclosures This is a basic description of insurance coverage. A total statement of coverage is found just in the policy. For more details on protection, prices, restrictions, and renewability, or to look for insurance coverage, contact your local State Farm agent. Insurance plan and/or connected riders and features might not be readily available in all states, and plan conditions might differ by state.

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - mortgage protection insurance through an agent. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

Degree term life insurance policy is the most straightforward means to get life cover. Therefore, it's likewise the most preferred. If the worst occurs and you pass away, you understand exactly what your loved ones will obtain. In this write-up, we'll explain what it is, exactly how it works and why level term may be best for you.

What is Term Life Insurance With Accelerated Death Benefit? Pros and Cons

Term life insurance coverage is a kind of plan that lasts a details length of time, called the term. You choose the size of the policy term when you first take out your life insurance. Maybe 5 years, 20 years and even more. If you die during the pre-selected term (and you have actually stayed up to date with your costs), your insurance provider will pay a swelling sum to your nominated beneficiaries.

Select your term and your quantity of cover. Select the plan that's right for you., you recognize your premiums will certainly stay the exact same throughout the term of the policy.

Life insurance coverage covers most scenarios of fatality, yet there will be some exclusions in the terms of the plan.

Hereafter, the plan finishes and the surviving companion is no more covered. Individuals usually get joint policies if they have outstanding economic commitments like a home loan, or if they have youngsters. Joint policies are usually much more budget-friendly than single life insurance plans. Other sorts of term life insurance policy policy are:Decreasing term life insurance - The amount of cover reduces over the size of the policy.

What Exactly Does Annual Renewable Term Life Insurance Offer?

This safeguards the buying power of your cover amount versus inflationLife cover is a fantastic point to have due to the fact that it offers financial protection for your dependents if the worst takes place and you die. Your enjoyed ones can also use your life insurance coverage payout to pay for your funeral. Whatever they pick to do, it's fantastic satisfaction for you.

Nevertheless, level term cover is fantastic for satisfying day-to-day living costs such as house expenses. You can also utilize your life insurance policy advantage to cover your interest-only home mortgage, repayment mortgage, institution fees or any kind of various other debts or continuous payments. On the various other hand, there are some downsides to level cover, contrasted to other kinds of life plan.

Term life insurance policy is an affordable and uncomplicated option for lots of people. You pay premiums each month and the insurance coverage lasts for the term length, which can be 10, 15, 20, 25 or thirty years. Level benefit term life insurance. But what happens to your costs as you age relies on the kind of term life insurance policy coverage you purchase.

What is Level Premium Term Life Insurance? Understanding Its Purpose?

As long as you proceed to pay your insurance coverage premiums monthly, you'll pay the same price throughout the entire term size which, for lots of term policies, is generally 10, 15, 20, 25 or thirty years. When the term ends, you can either pick to end your life insurance protection or renew your life insurance policy plan, normally at a greater rate.

For example, a 35-year-old female in outstanding wellness can get a 30-year, $500,000 Haven Term plan, provided by MassMutual beginning at $29.15 monthly. Over the following three decades, while the policy remains in location, the price of the insurance coverage will certainly not change over the term duration - 30-year level term life insurance. Let's admit it, most of us don't like for our costs to expand gradually

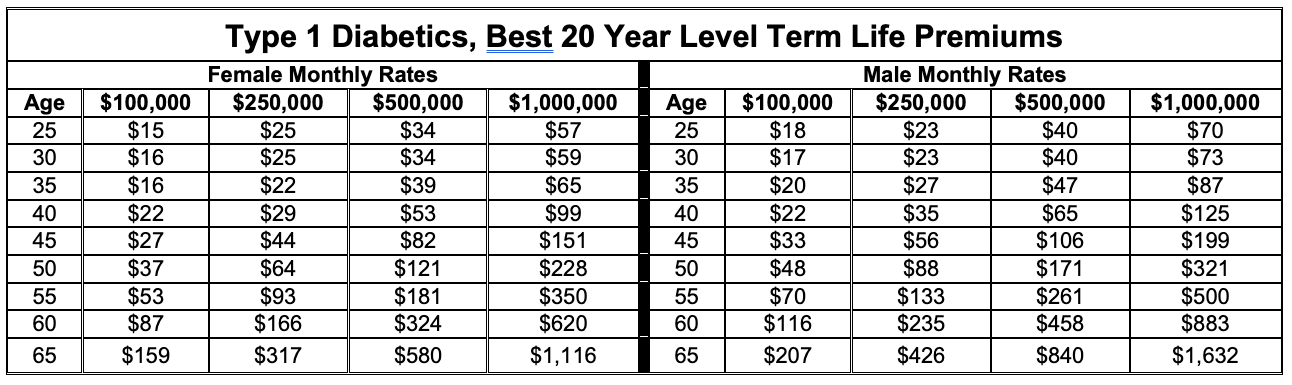

Your degree term price is identified by a variety of variables, a lot of which are related to your age and health and wellness. Other factors include your particular term policy, insurance policy service provider, advantage quantity or payout. Throughout the life insurance policy application process, you'll respond to inquiries concerning your health background, consisting of any kind of pre-existing problems like a vital illness.

Table of Contents

Latest Posts

Final Expense Companies

Decoding How Investment Plans Work A Comprehensive Guide to Investment Choices What Is Variable Annuity Vs Fixed Indexed Annuity? Benefits of Choosing the Right Financial Plan Why Fixed Vs Variable An

Burial Insurance Cost

More

Latest Posts

Final Expense Companies

Burial Insurance Cost