All Categories

Featured

If you're healthy and have actually never ever used cigarette, you'll typically pay even more for mortgage security insurance than you would for term life insurance policy (mortgage insurance vs term insurance). Unlike other types of insurance coverage, it's tough to obtain a quote for home loan security insurance coverage online - will i need mortgage insurance. Costs for mortgage protection insurance policy can differ commonly; there is less openness in this market and there are a lot of variables to accurately contrast costs

Term life is a superb option for mortgage protection. Policyholders can benefit from numerous advantages: The amount of protection isn't limited to your home mortgage equilibrium.

You might want your life insurance policy policy to safeguard even more than simply your home loan. You pick the policy value, so your protection can be a lot more or much less than your home loan balance. You could also have greater than one policy and "pile" them for personalized protection. By stacking policies, or motorcyclists on your plan, you can decrease the life insurance policy advantage in time as your mortgage balance reduces so you're not spending for protection you don't require.

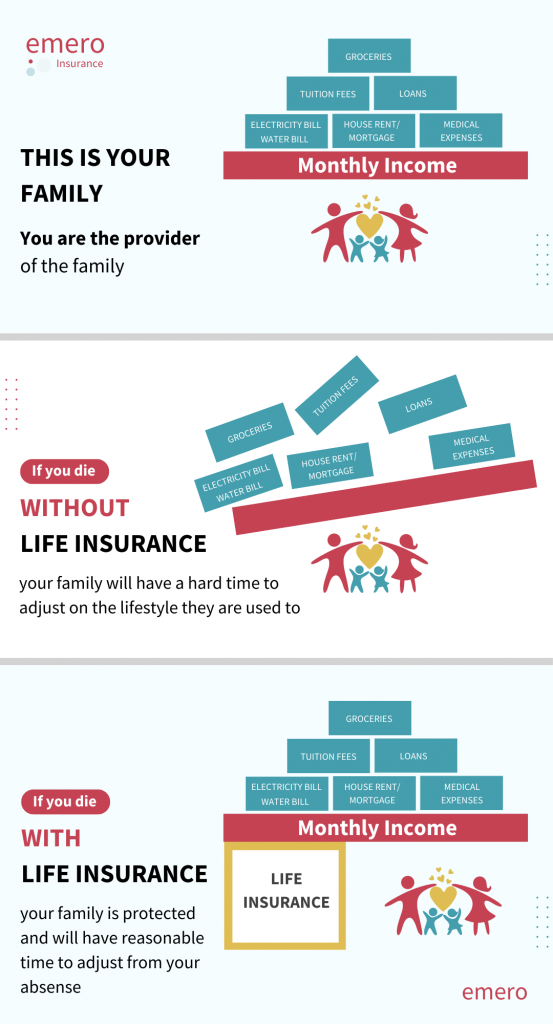

If you're insured and pass away while your term life plan is still energetic, your chosen liked one(s) can make use of the funds to pay the home loan or for an additional purpose they select. home mortgage group insurance. There are many benefits to using term life insurance coverage to protect your mortgage. Still, it might not be an ideal remedy for everybody

What Insurance Is Needed For A Mortgage

Yes, due to the fact that life insurance coverage plans have a tendency to align with the specifics of a home loan. If you purchase a 250,000 house with a 25-year mortgage, it makes feeling to acquire life insurance that covers you for this much, for this lengthy.

Your family or recipients get their round figure and they can invest it as they like (should i buy mortgage insurance). It's important to recognize, nonetheless, that the Mortgage Security payout sum decreases according to your mortgage term and balance, whereas degree term life insurance policy will certainly pay out the same swelling sum at any moment during the plan size

Payment Protection Insurance Quote

You might see that as you not getting your payment. Yet on the various other hand, you'll be active so It's not like spending for Netflix. You don't see an obvious or ahead of time return wherefore you acquire. The sum you invest on life insurance policy every month doesn't repay till you're no longer right here.

After you're gone, your loved ones don't have to fret about missing out on repayments or being unable to pay for living in their home (mortgage payment insurance protection). There are two primary varieties of home mortgage protection insurance policy, degree term and decreasing term. It's always best to get recommendations to figure out the plan that best talks with your demands, budget and situations

Latest Posts

Final Expense Companies

Decoding How Investment Plans Work A Comprehensive Guide to Investment Choices What Is Variable Annuity Vs Fixed Indexed Annuity? Benefits of Choosing the Right Financial Plan Why Fixed Vs Variable An

Burial Insurance Cost

More

Latest Posts

Final Expense Companies

Burial Insurance Cost